18 months ago I started pulling the thread on what would become my next company. 14 months ago Steven Schmatz joined me as my co-founder and our CTO. 12 months ago we signed our first design partners. 11 months ago we raised funding. 10 months ago we assembled our initial founding team. ~2 months ago we started onboarding new customers.

Today, I’m excited to officially introduce that company publicly. It’s called Taxwire.com.

Taxwire has kept a fairly low profile this past year as we’ve focused on building product and working with customers. We’ve recently hit new inflection points, making now feel as good a time as any to start sharing more about what we’re building, who we are, and what we stand for.

What we’re building

Taxwire solves sales tax compliance for entrepreneurs, finance, and accounting teams scaling across multiple states and countries. Anyone who’s operated a business that went from little revenue to a lot of revenue, fast – knows how complex, painful, and messy getting and staying sales tax compliant can be.

It’s how I got into this. (Jk I actually told investors that I was born thinking about taxes as a small child and that building tax software is my manifest destiny).

In all seriousness, Taxwire’s products and services help companies do the following:

Understand tax exposure – determine current sales tax nexus (e.g. what you should be doing), risk exposure, taxability of your products, and monitor changes to those things over time. The tax nerds call this a nexus study.

Fix messes – clean up messy tax situations (e.g. we went from 0 to $10M in revenue and have collected no taxes), save money on historical tax liabilities (e.g. we help you not get wrecked by penalties & interest from governments for historical taxes), overpayment of taxes (e.g. you paid too much or your current vendor made a mistake), etc.

Register – get and maintain licenses, registrations, and permits required for collecting/remitting taxes

Calculate tax rates – calculate and collect taxes accurately across your billing + payments + commerce stack (harder than it sounds)

File & pay tax returns – autofile recurring tax returns & remittance. In most jurisdictions filings are monthly or quarterly.

Other helpful things too, but these are the big ones.

Common scenarios where engaging with Taxwire makes sense:

Companies getting sales tax compliant for the 1st time – If your business has historically been non-compliant (e.g. you haven’t been collecting sales tax even though you should) or is just starting to cross meaningful revenue thresholds (e.g. $1-5M in revenue), our product + in-house tax experts can save you significant dollars on penalties when filing back-taxes with the states and headache in navigating state registrations.

Switching from Insert Legacy Tax Provider to Taxwire – If you’re switching from another tax software or services company, not only can we make the switch easy on both time and cost (e.g. buyout your current contract), but we can also find + fix previous tax errors, potentially recovering thousands of dollars in overpaid taxes.

I have no f*cking clue what I’m supposed to be doing. Pls help. – You’re not alone. We’ve helped a bunch of folks figure out a no B.S. take on what they need to be doing with sales tax. Send us a note and we’re happy to do an audit of your tax situation for free.

A good example of scenarios 1 and 2 – we recently helped our friends at Italic recover over $200k in overpaid sales tax within their first month post switching from their original provider.

Our customers

Today, we primarily serve software companies, e-commerce brands, and accounting firms.

Our customer base ranges from B2B SaaS cos like Pulley to digital media companies like Pirate Wires to e-commerce brands like Italic to retro video game brands like Modretro. Additionally, we’ve begun serving a handful of real-world industry companies across construction, services, manufacturing, etc.

And we love working with accounting firms that serve all the above and beyond.

Our team

Building a product that determines if companies are collecting and filing the right amount of taxes is a serious endeavor. Steven and I realized early on that this was not a space in which you could move fast and break things. From day 0, we prioritized recruiting an experienced team with domain expertise across engineering, fintech, and sales tax.

On the tax side, our Head of Tax Graham Martin was the first tax hire at TaxJar before Stripe acquired them in 2021. To my knowledge, he’s the only person that’s built 4 different tax engines from new product to millions of dollars in transactions (in some cases billions). He’s also a self-taught data engineer. Marissa Chu started her career on Avalara’s tax research team back in 2015 (years before they went public), worked on in-house tax automation at Amazon, and several other big names in the sales tax industry.

Our engineering team is a collection of fintech + ML expertise, startup vets, and former founder/CTOs (e.g. Aasim Sani who started 2 ML cos pre-Taxwire and pre-AI being cool). Since he would never brag about himself, I’ll do it for him. Our CTO Steven is one of the most cracked engineers I have ever worked with. Anyone that’s worked with him or on his team will tell you that he is an engineering god. I wrote his name down years ago as someone I would love to work with someday and feel very fortunate that said dream became a reality.

Why would anyone care about sales tax?

A fair question to ask for anyone that has never dealt with sales tax before is why the hell should they care about collecting sales tax?

The answer – Because you got into business to pay taxes god damn it. Jk. No one likes paying taxes, not even people whose business is built around helping others with taxes.

But Uncle Sam doesn't care and neither does Carol at the Texas Department of Revenue.

If you don’t collect sales tax, you will have to pay those tax dollars out of pocket to the gov + interest and penalties. Since the average tax rate is something like 5-10%, adding penalties and we’re starting to talk about serious dollars.

Before the internet, sales tax was a Fortune 500 company problem. Walmart has to worry about a tax burden across every state and country in the world, but not your average small-to-medium sized business.

Post-internet, the world changed. E-commerce became a thing with the rise of Ebay and Amazon. DTC disrupted retail. Commerce tech made it easier and easier to sell online and ship stuff anywhere. See Shopify, Woocommerce, Magento, and many other platforms/tools.

Software itself moved from on-premise installations to cloud-based and subscriptions. Today, we have usage-based pricing and AI is eating everything.

Recent regulatory changes in the US and abroad have now made collecting and remitting sales tax, VAT, and GST a problem for virtually any company with material sales in more than one jurisdiction, even if you’ve never physically been there.

Why building an accurate sales tax product is hard

And sadly, building a sales tax product is also far more difficult than slapping some tax rates into a database and calling it a day. As I’ve written about previously:

“there is no IRS for sales tax. No single entity you register and file returns with. Rather, the sales tax law is regulated by individual states, counties, and cities. There’s no universal standard. The tax law and rates in Ohio are different than in California. The tax rate varies all the way down to the state, city, country, municipality, and special district level.”

According to our internal source of truth on tax jurisdictions, there are 10-20k+ different tax jurisdictions in the US alone (depending on how you define tax jurisdiction. even the tax nerds don’t agree on this one). That doesn’t account for all of the complicated tax law (statutes, rules, exemptions, edge cases, etc.) on how individual products, industries, and business models are taxed.

To build an accurate sales tax product you need to achieve the following:

Rooftop accurate tax rates – These are basically hyper-precise tax rates calculated based on a specific location’s exact latitude and longitude — right down to the individual building or “rooftop.” This contrasts with tax rate calculations based on zip code or zip+4 level data, which can often lead to inaccuracies due to overlapping or varying tax jurisdictions within these broader areas. Zip code is only 50-60% accurate. Zip+4 ~90%. To achieve rooftop, you need to construct your own source of truth for all those thousands of tax jurisdictions in the US. No easy task as these boundaries blur significantly and there is no publicly available dataset for this.

Tax content – All the rules, exemptions, edge cases, etc. on what is and isn’t taxed across the US. We’re basically talking about turning the US sales tax code and statutes into software.

Maintenance of updates / changes to tax rates, laws, etc. – These rates and rules change somewhat frequently. You have to be able to stay on top of those changes or your software is wrong. In 2022 for example, there were 600+ different changes in the US alone.

Construction and reconstruction of transaction data – Businesses and sales data are complex. Most companies sell across multiple different channels, payment systems/methods, billing systems, accounting systems, etc. A SaaS company might have sales data across Stripe, PayPal, Quickbooks, an external or in-house billing system, etc. An e-commerce brand might sell on Shopify, Amazon, TikTok shop, send wholesale invoices in Netsuite or QBO, etc. Physical retailers have POS systems, e-commerce storefronts, 3rd-party delivery orders (DoorDash, UberEats), etc. This stuff gets complex fast. You have to be able to pull all of it together in a way that allows you to calculate the end tax return in each jurisdiction accurately.

Reporting customized to each tax jurisdiction’s unique schema – Yet again, every state and country is different. Sometimes wildly different. If you want to automate + file accurate tax returns, you need to be able to turn all of this data into a format that matches what the tax authorities expect to see.

Powerful, simple, and flexible data model – A singular data model that ties all of the above together into the right abstractions enabling accuracy, ease of use + implementation, and automation. If you don’t do that, your system is going to be a nightmare to use and maintain (looking at you Avalara).

I could keep going, but for the sake of time we’ll move on. tl;dr – building a sales tax product the right way is not for the faint of heart.

Why the world needs a better sales tax product

Competition is for winners

Now this is usually where some tech bro that just read zero to one will tell me, but “Andrew, competition is for losers. Peter Thiel said so.”

Yeah and one of the top winners from Peter Thiel / Founders Fund’s portfolio is Ramp. The latest of late movers to corporate cards and expense management.

Real problems that real people and companies spend money to solve have competition. End of story. If you somehow don’t have competition, you’re either building something no one wants or you’re gonna have a lot of competition real soon.

You can run from competition while our team goes to war.

The competition

The question to ask about competition isn’t “why compete if other players exist”.

The questions to ask are – Who are you competing with? Why do customers need better solutions? Why is your solution better? Etc.

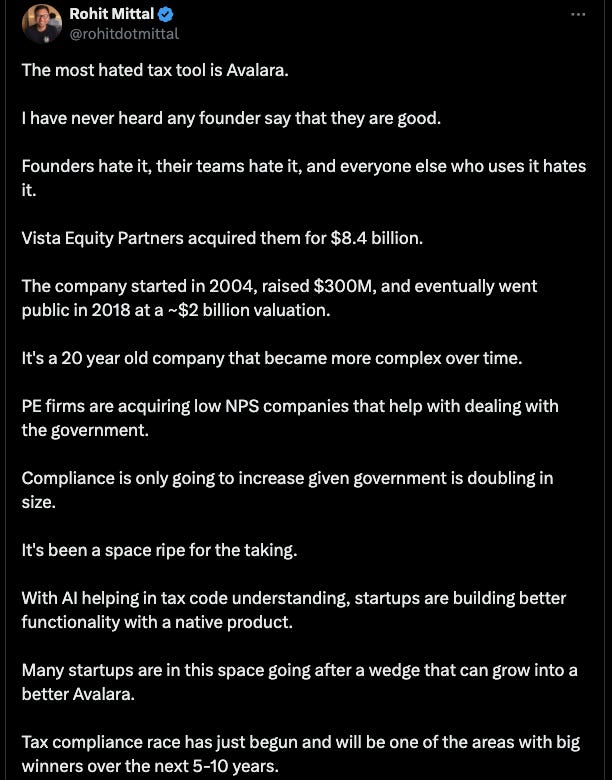

Incumbents

Sales tax has long been dominated by big players like Avalara (SMB & Mid-market) and Vertex (enterprise). TaxJar (where some on our team used to work) made a dent against Avalara’s dominance, but Stripe bought them and the product is respectfully not what it used to be.

Anyone who’s purchased from Avalara knows it’s a frustratingly complex product to use and implement with some of the worst performance and customer service known to man. They think it’s okay to be late in filing your taxes every month. They think it’s okay to miss filing your taxes and make you pay the penalties for their mistake. They think it’s okay to take 3 weeks to respond to CX tickets. They think it’s okay to have their Quickbooks integration break and take 2 months to fix that. They think it’s okay for it to take 5 minutes to load a god damn app page (sorry I still have PTSD).

Services firms

There are a bunch of consulting/CPA firms like KPMG that have made a ton of money charging for services on things that can be 100 or 90% software today. Not 10 years from now… today.

Some of these folks also make money on charging for professional services to help implement Avalara’s complicated ass product.

Their dramatically marked up fees on junior associate billable hours is our opportunity.

Note: There are some super dope services firms out there that provide a ton of value software still cannot. This is not about those folks.

New startups

Because most of these incumbent products and services firms leave much to be desired, a few new startups have arrived to compete with them. This is mostly a good thing. Competition is inevitable in a big fast-growing market like this. Those that are trying to help customers will always have my respect. However, those of you hiding inaccurate products under the guise of AI on unwitting customers are my mortal enemies.

So for Taxwire, we don’t really care that there is competition. We only care about obsessing over customers, building the product that we think should exist, and then distributing the hell out of it.

But don’t get me wrong, I wouldn’t be doing this with my life if I

thought others were building their products the right way, and

didn’t both plan and intend to win

Why Taxwire is different

The fundamental difference in our approach vs competitors is an obsession with accuracy, product quality, and implementation ease.

We believe that the foundational way most tax products (new and old) have been built is fundamentally flawed.

Both the incumbents and the newcomers followed the same traditional silicon valley wisdom of building a basic initial product, onboarding as many customers as fast as possible, and adding functionality + coverage for complexity later.

“Move fast. Break things.” “Let’s just make it good enough.” “We can fix that later.” “Our customers won’t know better.”

The problem with this approach in sales tax is that the entire global indirect tax system is edge cases compounded upon edge cases. And you cost your customers money and/or create liability and audit risk if you fuck up.

Products with flawed foundations quickly find themselves in a position where:

their outputs aren’t accurate enough (not that accuracy matters with taxes or anything)

they can’t support edge cases

can’t support complexity (every business adds complexity as it grows, I don’t make the rules)

can’t expand industries or tax coverage without refactoring their technical foundation

can’t actually automate the end tax filings

etc.

Maybe you get away with it for a while because customers don’t know better. But not forever. Eventually they find out or the auditors do.

Taxwire has taken the opposite approach — building a core data model, set of abstractions, and aggregation of tax data that lets us handle both complex and simple use cases from day one.

Our product is built to handle any edge case, industry, billing model, tax type, etc. – in the global transaction tax system. We built from day one for accuracy and complexity. We started with the end game in mind.

For customers, this approach makes Taxwire significantly more accurate, more automated, and easier to use / implement.

It also lets us focus more of our future product efforts on building new products and features for our customers instead of improving our initial product.

For example, we’ve already begun to automate afore-mentioned compliance processes, workflows, and filings that were historically the domain of consulting firms, saving our customers more time and money.

Internally, this lets us build and maintain our core tax engine with a fraction of the headcount competitors have, while leveraging modern technology like LLMs safely and effectively.

Where we’re going from here

Sales tax is a much bigger problem space than most realize. If you look at the macro, no one, not even the multi-billion dollar incumbents, have solved this problem globally. VAT and GST taxes in the many international jurisdictions around the world have their own significant challenges.

There are also several similar tax types and problems that face companies expanding globally at the state or country level. Larger companies also face intense scrutiny from tax authorities.

Our number one objective is to solve sales tax compliance for every jurisdiction, product, and edge case globally. To build the best product possible. To earn their trust. To make their lives the slightest bit easier. To eliminate one more headache they’d otherwise be dealing with.

If we do that successfully, I believe we’ll have earned the right to solve additional, similar, and/or adjacent problems for our customers.

But let’s not get ahead of ourselves. Software companies win in the long-run because they are focused and obsessed on solving core customer problems better than anyone else… and then expanding. Not before.

I have deep conviction in the team we’ve built and the way we’ve built our product.

But don’t take that as overconfidence. We have much work to do to make this the best product and service on the market, globally.

We are just getting started.

If the above excites you, we’re hiring more engineers. (yes this was secretly a recruiting post I hope it worked).

If you’ve dealt with or are dealing with sales tax compliance for your business or clients, I’d love to chat, share what we’ve built, and see how we can help.

On a final note, I recently wrote that I've never felt more conviction on anything I've done in my life.

Working with this team, our investors, building this product, and serving our customers has been the greatest privilege of my life and career.

I am deeply grateful.

More from Taxwire soon. 🫡